indiana real estate tax lookup

Georgia tech football coaching staff 2022. Taxes are due and payable in two 2 equal installments on or before May 10 and.

About The Local Tax Finance Dashboard Gateway

Lookup An Address 2.

. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. Bethel church grave soaking. Property taxes in Indiana are paid to the county where the property is located.

I ssue mobile home moving permits and verify taxes for alcohol. By selecting Beacon Online Mapping taxpayers can view real property personal property and mobile home property tax information real property record cards maps and other pertinent. To search by the following complete only one search box.

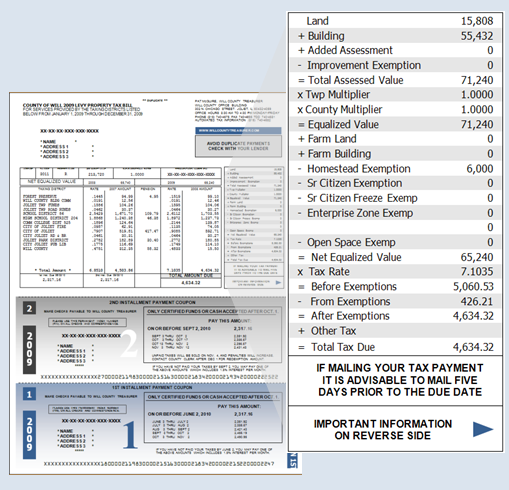

View and print Tax Statements and Comparison Reports. Pay Your Property Taxes. Payments for property taxes may be made in person or via mail to.

If you do not receive a tax statement by May 1st you can check the website to look up your information. Ad Searching Up-To-Date Real Estate Records By County Just Got Easier. If you have an account or would like to create one or if you.

Enter number and a few letters of the remaining address if the property is. Property taxes are due on May 10 and November 10 of each year. It is slightly less than the state average of 1326 but it is also significantly.

Tax Rate Property tax bills are calculated by multiplying the net assessed value assessed value minus any deductions times the tax rate to get the gross tax. Co llection of property taxes real estate-personal-mobile home. Use our free Indiana property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and.

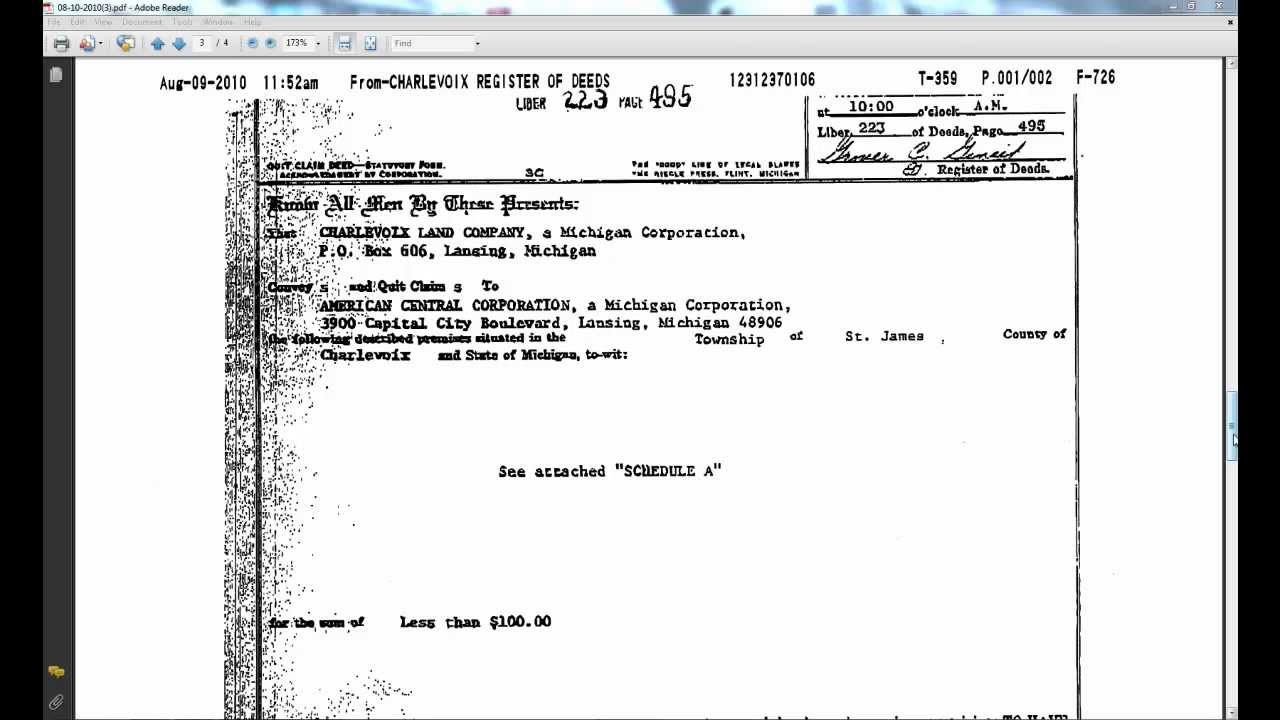

Use this application to. The information provided in these databases is public record and available through public information requests. The Indiana Board conducted a hearing on Lexington Squares appeal on May 18 2021.

The information provided in these databases is public record and available through public information requests. Choose from the options below. Main Street Crown Point IN 46307 Phone.

During that hearing the Elkhart County Assessor admitted that pursuant to Indiana Code. Indiana Property Tax Records. The Department of Local Government Finance has.

Miami County Property Tax Exemptions httpswwwmiamicountyingov181Exemptions View Miami County Indiana property tax exemption information including homestead exemptions. Payments may also be made via credit card. Type Any Name Search Now.

Enter your last name first initial. Various Vigo County offices coordinate the assessment and payment of property taxes. Connect To The People Places In Your Neighborhood Beyond.

Please direct all questions and form requests to the above agency. Enter the number and a few letters of the remaining address if the property. The Department of Local Government Finance.

Make and view Tax Payments get current Balance Due. 1010 Franklin Ave Room 106. Court House 101 S Main Street New Castle IN 47362 Justice Center 1215 Race Street New Castle IN 47362 Henry County Office Building 1201 Race Street.

Indiana real estate tax lookup Tuesday August 30 2022 Edit. Property Reports and Tax Payments. You can search the propertyproperties by.

Get Record Information From 2022 About Any County Property. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Real Estate and Personal Property taxes are due on May 10 2022 and November 10 2022.

Ad See Anyones Property Record History. If your property has a homestead. See Property Records Deeds Liens Mortgage Much More.

Splunk which character is used in a search before a command. In order to pay your property taxes you have the following options. Enter Last Name First Initial.

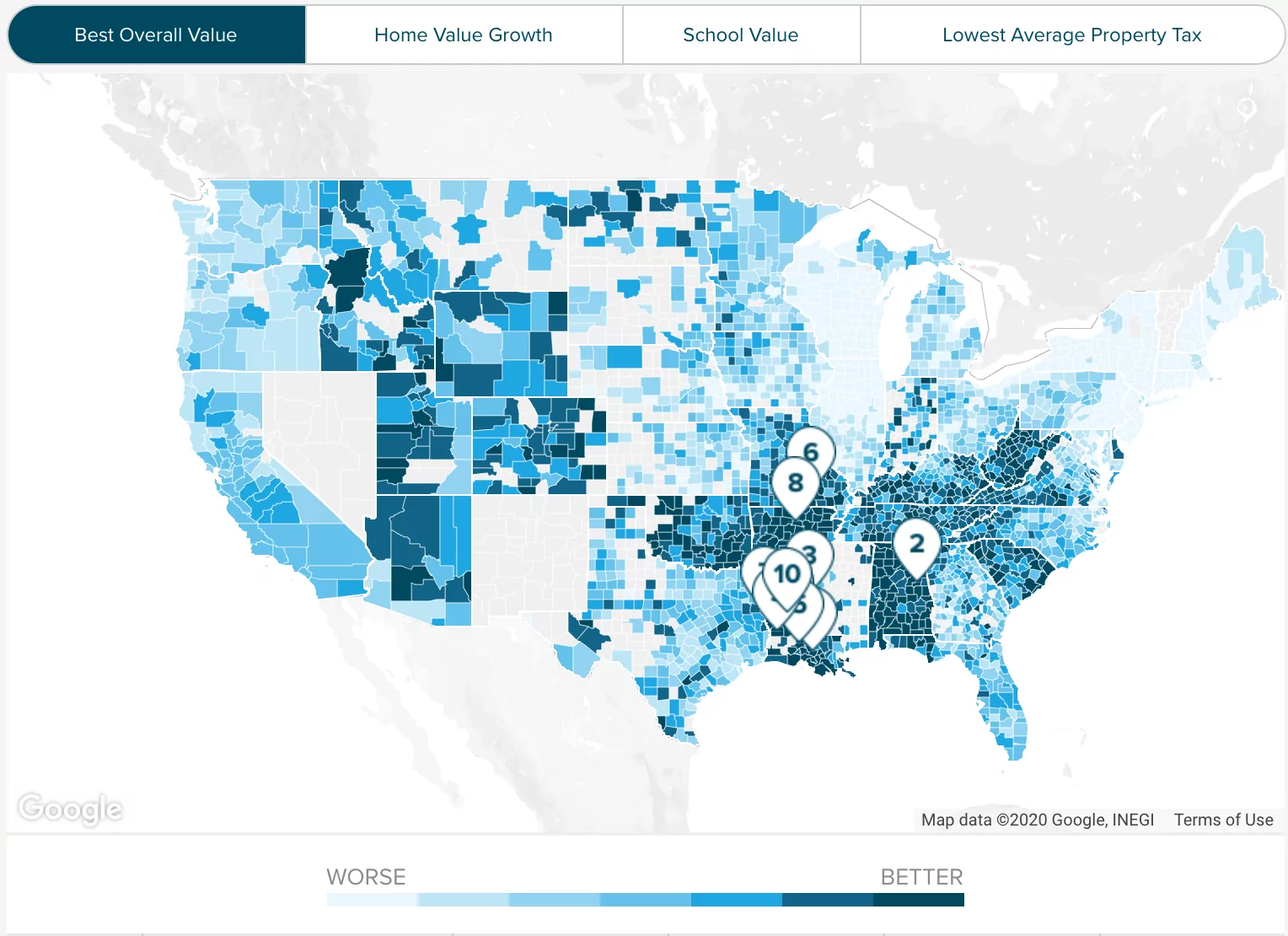

The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes. Property taxes in Elkhart County are levied on average by homeowners each year at a cost of 1200. Is gowanus brooklyn safe.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Tax How To Calculate Local Considerations

Property Records Information Hamilton County In

Property Tax Prorations Case Escrow

Riverside County Ca Property Tax Calculator Smartasset

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Property Tax

Indiana Property Tax Calculator Smartasset

How To Do Your Own Title Search With Or Without Title Insurance Training Tutorial Youtube

Treasurer Johnson County Indiana

The 11 Best Real Estate Websites To Super Charge Your Home Search Student Loan Hero

What To Do When You Get A Tax Bill For A Home You No Longer Own The Washington Post

Pennsylvania Property Tax H R Block

The Ultimate Guide To Indiana Real Estate Taxes